Starting a business may sound like an overwhelming task, but it's more commonplace than you may think. With over 5 million SMEs in the UK, and over half of those businesses employing under 10 people, small independent companies are a thriving and growing part of the national economy.

The first and most important thing to think about when starting out on your own is deciding on the nature of business and assessing demand. It might be the case that you choose to go for something that you enjoy, turning a hobby into a career. Or you might build a company of freelance professionals based on your past work experience. Whatever direction you choose to go in, support is always on hand at Easy Digital Company to turn your idea into a business.

Here's how to get started:

Business Name:

No matter what type of business you go into, you need to have a name! A unique business name is not only a practical and official way to identify your company, it's also a very useful tool for establishing your business and creating brand recognition within your chosen industry.

How to choose a company name:

1. Check name availability

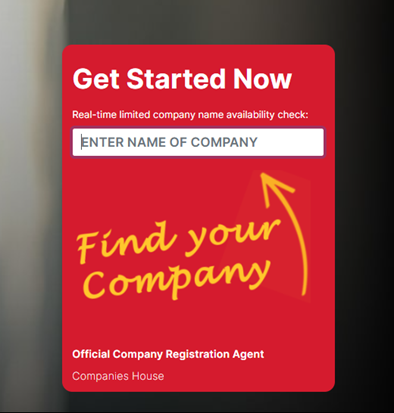

Once you have decided on a company name, you need to check if its available. If the name has already been registered by another company, then you won’t be able to incorporate using the same name, so you'll need to think of something unique. You can check whether a name is available by using our company name checking tool, which scans the Companies House website in real time to give you up to date information on which names are registered.

2. Ensure your name stands out and check the competition

The name that you choose should not only be unique, it needs to communicate your brand and stand out from other companies with similar names to avoid confusing your target market.

3. Make sure your name is accessible

Having a company name that is easy to read and write is a bonus for helping spread awareness and making it more memorable. That way when you are getting your brand out there, whether this is through advertising, business fairs, or building up your presence online; once people hear your business name, they won't easily forget it.

4. Ask family and friends

After deciding on your company name, it is always helpful to speak to people you know for feedback be they friends, family, colleagues, mentors or other professionals in your industry. Their observations are an invaluable source of market research, which can help steer you on the right track.

For more information on how to choose a name that's right for your company, please feel free to take a look at our related article ‘Choosing a company name for incorporation’ on our Knowledge Base.

Business Logo:

Whilst your business name is essential for legally registering a company, you cannot overlook the significance of a logo! A company’s logo has the opportunity to grab attention and create lasting impressions that helps your business to get recognised, and it can be one of the most impactful and cost-effective marketing tools for new businesses with a limited budget.

How to choose a company logo:

1. Understand the identity of your brand

Before you begin to think about the actual design of your logo, it is necessary to dive deeper into the values and mission of your company. Through this you should also gain a better understanding of who the company’s target audience is, which will help guide the creation of your logo.

2. Decide on the key elements

Once you have formed an idea around brand identity, you can begin to think about colour, font, and imagery. You might wish to consult a graphic designer later on, but do your research first as there's plenty of free advice and tips online about what makes a good logo.

3. Assess competitor logos

It's important to be aware of the competition at every stage of development, so cross check your ideas to make sure your logo, like your name cannot be easily confused with others.

Next Steps

Incorporating Your Business:

While many people assume they should launch as a sole trader, deciding to incorporate a limited (LTD) company officially separates you and the business as a legal entity in its own right, protecting you against losses and enabling future growth.

At Easy Digital Company we specialise in company incorporation and offer a range of straightforward solutions to help companies launch with confidence, and easily meet their legal and compliance requirements for starting a business.

How to Start a Small Business with Us.

1. Head to easydigitalcompany.com.

2. Enter your chosen name under 'Get Started Now'.

If the chosen name is available, then a green check will appear and you can proceed by clicking on ‘Register This Company’. If the name is not available, then the form will display an ‘X’ for you to choose an alternative.

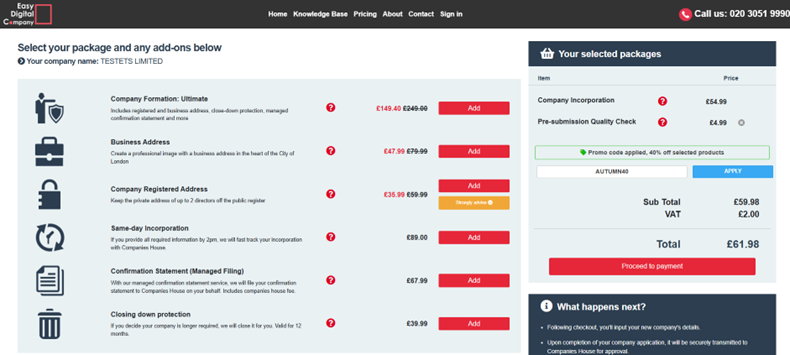

3. Select your company formation package.

The Essential incorporation package is selected by default which includes basic company incorporation with Companies House, but depending on the needs of your business you may wish to choose another package with select add on services. Check out our pricing for a breakdown of what each of our packages has to offer.

Top Tip: Our Recommended package includes a registered business address to protect your personal address from appearing on the public register and for handling official correspondence from Companies House and HMRC.

4. Enter your company information.

You will need to enter the company address, number of shares held by each director/shareholder and the principal activity of the company. You will also need to complete the directors’ details for us to carry out mandatory Anti Money Laundering (AML) checks. For detailed information on what is required, please feel free to check out our article ‘What are AML Checks for Company Incorporation?’ on our Knowledge Base.

5. Submit your application and we'll do the rest!

After you have completed the information and submitted your details, we will complete the application for you and submit it to Companies House. Once your company has been successfully incorporated, we will send you an email to confirm, along with the company registration number and details of your certification of incorporation.

Filing to Companies House and HMRC

Once your first accounting period has ended, you will be expected to submit your annual company returns and confirmation statement to Companies House - this will then need to be done for each subsequent accounting period. You will also need to submit annual accounts for tax purposes to HMRC.

Top Tip: Remember that Companies House and HMRC are two separate organisations with different filing requirements; but don't let this put you off! We help you to keep track of what you need to file and when, so you stay on top of compliance.

Here is a bit more detail on what your filing requirements might be:

Companies House:

- Dormant Companies

- If your company is dormant, meaning that there were no income or expenses incurred during the period, you will still need to file your annual accounts to Companies House, no matter whether you are a limited company or limited liability partnership.

- Micro Companies

- A micro entity is one that has two of the following: a taxable turnover of £632,000 or less, 10 or less employees, or a balance sheet of £316,000 or less. Typically, most companies are considered as micro entities after their first year of trading as the business just starts to get off the ground. They will be required to complete abridged (balance sheet only) micro company accounts (under the Financial Reporting Standard 105).

- Small Companies

- A small entity is one that has two of the following: a taxable turnover of £10.2 million or less, 50 or less employees, or a balance sheet of £5.1 million or less. Small companies are also required to complete abridged (balance sheet only) small company accounts (however they are completed under the Financial Reporting Standard 102).

HMRC:

- Dormant Companies

- Typically, dormant companies are not required to submit dormant tax returns to HMRC, however, you may be required to if they have sent you a notice to file a corporation tax return letter. As the company has not traded in the period, you can submit a nil tax return to HMRC.

- Micro and Small Limited Companies

- Both micro and small limited companies are required to submit full accounts along with the corporation tax return to HMRC for each accounting period. The type of counts you submit will depend on what size your company is (whether it is under FRS 105 or FRS 102).

- Limited Liability Partnerships

- No matter what size your LLP is, you will need to submit an SA800 (self-assessment) tax return to HMRC. Only one SA800 return needs to be submitted for the partnership, however, each partner within the company will also need to submit an individual self-assessment tax return (an SA100).

For more on the different filing requirements for micro vs small companies, please feel free to check out our article ‘Filing Under FRS 102 & 105 for Small and Micro Companies’ on the Easy Digital Filing Knowledge Base.

Get Started with Easy Digital

While Easy Digital Company helps you to launch your business and submit your company accounts, our parent company Easy Digital Filing can take care of your tax filing requirements. We offer self-filing packages (where you use our comprehensive filing templates to complete and submit the returns to HMRC or Companies House), or managed filing packages (where we complete and submit the returns for you, based on information provided). If you want to find out more about our tax filing service, head over to easydigitalfiling.com and create a free account to start using the platform.