Managing your company information

When running a business, sometimes it can be hard to manage all of the company's information, from company registered number to keeping track of company mail, as well as deadlines relating to the business. To help manage your company, our Easy Digital Company portal has all of your important company information collated and displayed in just one place to view!

Once incorporated through our system, simply log into your Easy Digital Company account and head to the 'My Companies' page, here you will be able to view all of the standard company information that has been submitted to Companies House as well as well as any HMRC or Companies House filing due dates. We also offer different add-on services for companies incorporated through us!

My Companies

Company Information

All of the following information displayed in your account, will be taken directly from the incorporation documents submitted directly from our software to Companies house.

- Company type - this is the company's legal entity type, for example: a limited company or a Limited Liability Partnership.

- Company registered number - the unique number assigned to the company upon incorporation by Companies House. This is often used when running a business as a legal identifier along with Company name.

- Date of Incorporation

- Company registered address - This is the legal correspondence address required by Companies House. If you selected our 'Registered Address' package as part of incorporation, then this will be our City of London address.

The list of company information also includes your LEID number, which is your unique Easy Digital number assigned to your company and includes your accounts reference date. There is also an option to download and view your certificate of incorporation directly from the portal.

Company Authentication Information

We also have a section within your account, that lists both the Companies House and

HMRC authentication credentials, these are needed when managing a company for such duties as filing your annual accounts and tax return. These details include the company’s:

• Companies House Authentication code – This is sent to the limited company’s registered address, typically within 5 days of the company incorporation.

• HMRC UTR (unique taxpayer reference) number – This is also sent to the company’s registered address, within 14 days of the company incorporation.

• HMRC Gateway Password – These are the credentials used to sign in to the limited company’s Government Gateway Account once created.

This information can be entered in your

Easy Digital Filing account when it comes time for you to submit any necessary returns and it will automatically update your Easy Digital Company portal!

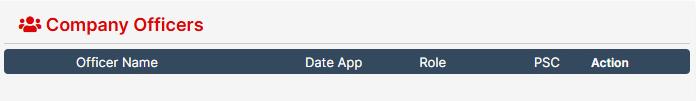

Company Officers

You can view all of the current company officers/ directors of the company, which is displayed within the Easy Digital Company portal. Including the date of appointment, the role of the officer and whether they are a Person with Significant Control (PSC).

Whilst running a business, if any director/officer is looking to resign from the company, we also have an option to resign any of the officers through our software. If you are looking to proceed with this action, it will submit an electronic request to Companies House to resign the chosen company officer. This can take 2-6 hours to have affect on the company’s public record.

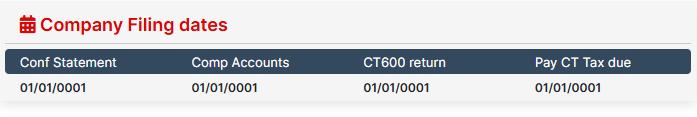

Company Filing Dates

Our Easy Digital Company portal also has a ‘Company Filing Dates’ section, which will display all of the businesses HMRC and Companies House filing deadlines, including:

• Confirmation Statement deadline

• Company Accounts deadline to Companies House

• CT600 return deadline to HMRC

• Deadline for any corporation tax due from the CT600 return

Having all of your return deadlines in one space, is a good way to manage a company to prepare for which due dates are approaching soon!

Company Actions and Services

Within our Easy Digital Company customer portal, we offer the option to further customise your account with us by adding services!

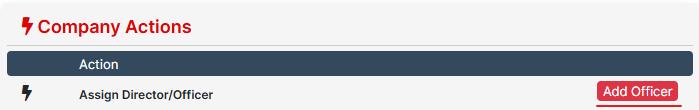

Company Actions

In this section of the company portal, you will have the ability to assign a new company director/officer to your existing limited company.

We also offer the ‘Officer Service Address’ package, which is a managed service for officers wishing to keep their residential address private from the public register, which costs £2.23/month.

Once the package has been purchased, and the new officer details have been completed, a request to add the new officer will be submitted to Companies House. Having a serviced address that is not your home address whilst running a business will make you look more professional to potential customers.

Additional Services

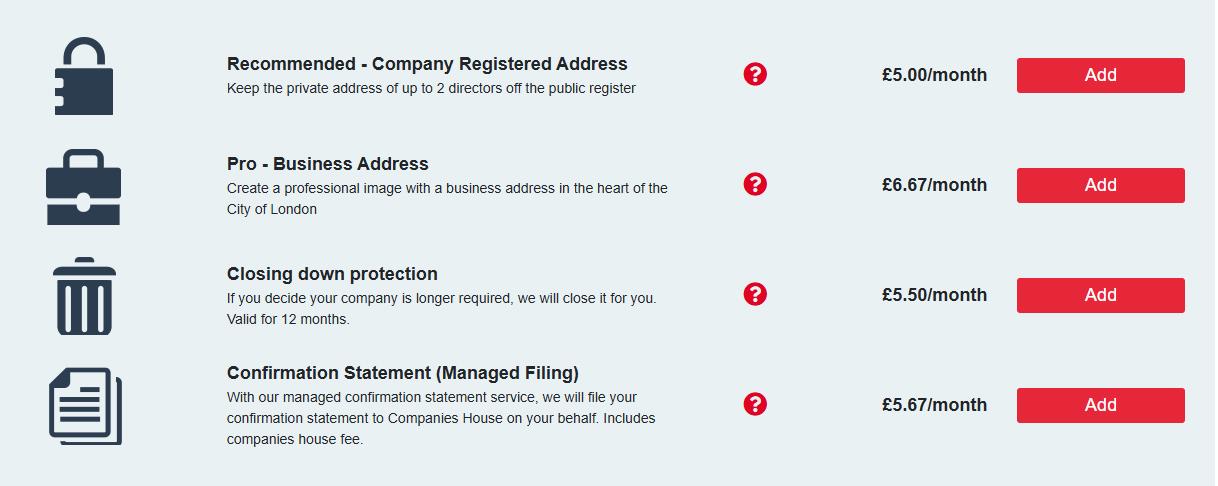

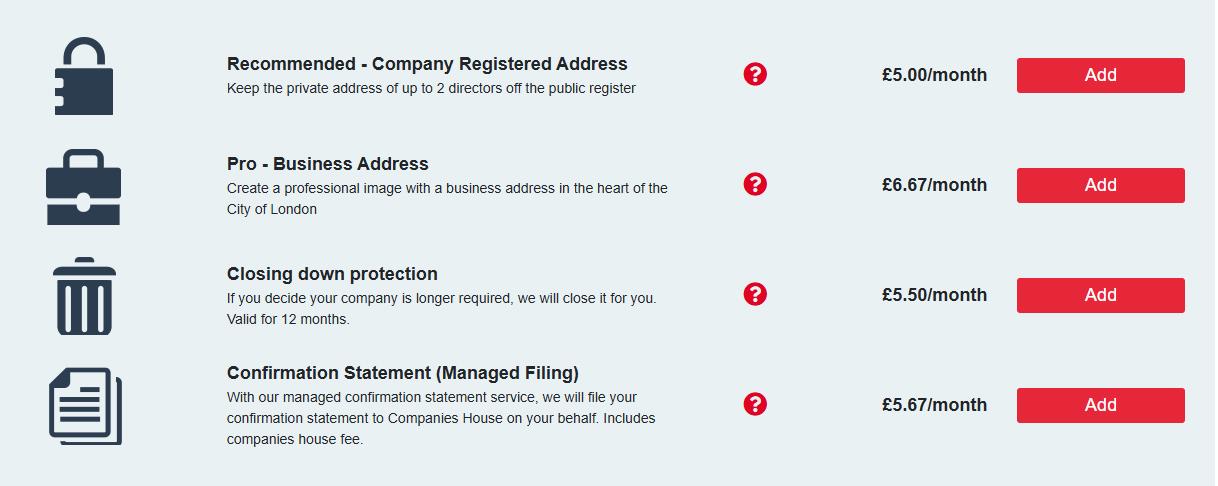

We provide 'add-on' services, where you will be able to purchase any of our add-ons that you may not have previously bought when incorporating through us. These can be found by clicking the 'Add Service' link under the 'Services' section within your account.

The list of these services include:

- Company Registered Address - This package will allow you to change your registered address to our City of London one, which will help protect the private addresses of up to 2 directors.

- Business Address - An add on from our Registered Address package, allowing for business activities being conducted at our City of London address.

- Closing Down Protection - if this package has been purchased and you are looking to strike off your limited company, we help to close it down for you.

- Confirmation Statement (Managed Filing) - This is an annual requirement that is required whilst managing a company. This is the service where one of our Accounts Specialists completes and submits your Confirmation Statement filing to Companies House for you.

Additions like these may be beneficial and can be more efficient for running a business.

Mail (Registered Address Customers)

For the Easy Digital Company customers who have purchased our Registered Office address package, we are able to process any mail that is received to our City of London office address on your behalf, making it easy when managing a company.

Our team will scan and upload any important mail that is received to our office to your Easy Digital Company portal. This can be accessed by heading to the 'Managed Mail' tab within your account. Then, once this has been uploaded to your account, you will be notified via email that there is new mail to view and how to access it.

Mail received to our office can include any of the following:

- Companies House Authentication Code

- Company UTR and HMRC credentials

- Notice to file letters from HMRC

As well as any late filing notices or penalties.

This simplifies managing a company as all your compliance documents are in one place and easy to access.

We also keep copies of all the mail received, so if you would like to have a physical copy of the mail for your records, we can send it to the address of your choosing upon request! Selecting our Registered Office Address package is a great way of managing a company by keeping on top of any company filing deadlines as well as receiving necessary company information.

Overview

So there you have it, all of your limited company incorporated information all on in one space available to view, as well as all of our additional services offered in the Easy Digital Company portal.

If you did not purchase any of the additional services upon incorporation with us, you will be able to purchase these in the 'Add Services' section of your Easy Digital Company account and our team will proceed accordingly.

This article is information only and has been prepared for general guidance on matters of interest only, and does not constitute legal, accounting, tax, investment or other professional advice or services. You should not act upon the information contained in this article without obtaining specific professional or legal advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this article, and, to the extent permitted by law, Comdal Limited, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.