There are many benefits to opening a limited company, however, it may seem like an overwhelming task for just one person. It leaves many people to wonder whether you can actually be the only person in a limited company? Well, put simply, yes - you can open a limited company and be the only person in it!

To open a limited company, you need to have a minimum of just one director or officer - you are not required to have multiple. Depending on the type of company you want to open, you may also have shareholders or guarantors.

Shareholders and Guarantors

A limited company (limited by shares) must have at least one director and one shareholder, and a limited company (limited by guarantee) must have at least one director and one guarantor. One person can assume both positions, so the sole director can also be the sole shareholder or guarantor.

Limited by Shares:

As mentioned, the director can also be the only shareholder - if this is the case, then the director holds 100% of the company's shares. While there is a minimum number of shareholders, which is one, there is no maximum, so you can have as many shareholders as desired. There are also no rules regarding the price of the shares, so you can make these worth any value you would like. However, it is important to note that these shares will eventually need to be paid off by the shareholders, so the price of the shares does matter! You can either pay for the shares when they are issued after incorporation, or you can pay them at a later stage. If the company shuts down, then the shareholders will be required to pay their shares in full, if they have not already done so.

The company's shares are determined when you register your company, however, you can change the number of shares after incorporation, if necessary. As part of the company's incorporation, you are required to have a 'Statement of Capital' - this includes the number of shares the company has, the type of shares they are, and their total value (which is known as the share capital). It must also include the names and addresses of the shareholders, and how many each 'member' has. The type of share, or 'class', determines what rights each of the shareholders have.

For example, a company might decide to issue 500 shares at £1 per share - this would mean that the company has a share capital of £500. If the company has just one director/shareholder, then they would hold all of the 500 shares themselves, and would be expected to pay it.

It is important to note that a company's worth is not determined by its share capital.

How to issue shares when you incorporate through EDC:

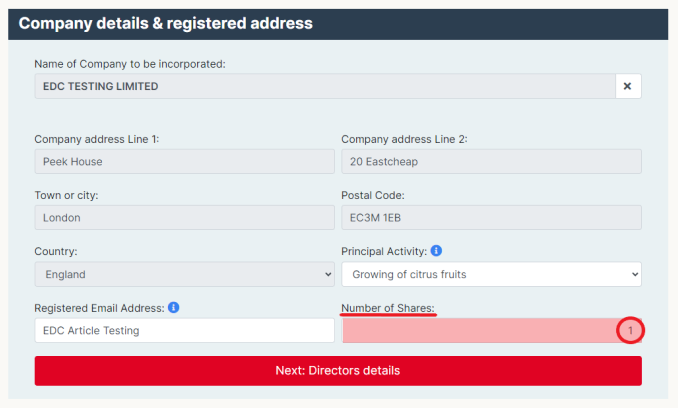

If you are choosing to incorporate your new company through Easy Digital Company, we make it very easy to change the number of shares that you wish to issue for your company. Once you have entered the company name you wish to incorporate, selected the packages you require, and then purchased them, you will be taken to a page where you can begin to enter your information. On this first page is the 'Company details & registered address' information, where you can also select the number of shares you wish to issue.

You can click on the box to type your desired number of shares (you can select any figure up to 100).

How to incorporate a company with just one director through EDC:

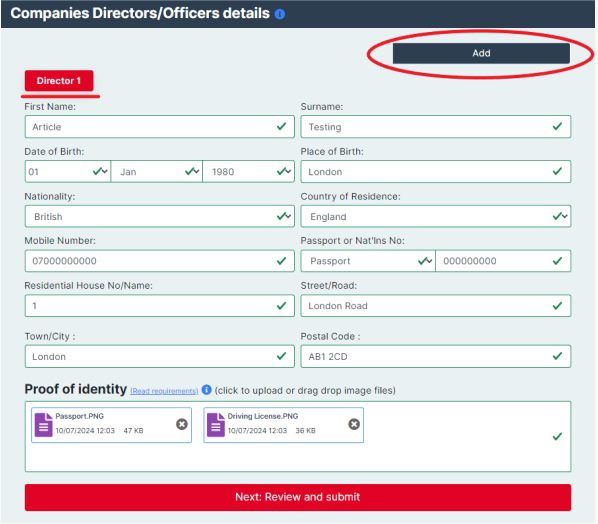

After you have completed the 'Company details & registered address' page, you are taken to the 'Companies Directors/Officers details' page, where you can select the number of directors and enter their information. The page is automatically set to just one director, so if that is what you desire, then you can just complete the information and then click on 'Next: Review and submit'. However, if you would like to add another director, then you can click on the dark blue 'Add' button, which will then add another director where you can also enter their information before proceeding.

Limited by Guarantee:

Companies that are limited by guarantee are typically 'not for profit' companies, meaning that they do not keep their profits, and instead, they invest their profits back into the company. Often times charities, sports clubs, societies, etc., are limited by guarantee rather than by shares.

This means that the guarantors are only liable for the amount that they guaranteed. For example, if the amount guaranteed was £5 per member, then the guarantors will only be liable for that amount.

With this type of company, the guarantors are not typically expecting there to be any financial benefits, as they are committed to the company's objectives, rather than finances. This means that guarantors cannot receive dividends, whereas shareholders can.

Numbers of Employees

You can open a limited company with 0 employees. Directors do not count as employees unless they are paid by the company through PAYE, so if the director is not on the company's payroll, then they are not considered as an employee. So, if there are no employees on the payroll, then there are technically no employees. This is important to remember for when you are completing your end of year accounts, as you are required to note the number of employees in your company during the accounting period.

The director may still choose to be paid by the company, but they can do this through receiving dividends instead of being paid on a salary through PAYE. This is not considered as a salary as it is not part of the payroll, however, the directors do need to declare the amount of dividends received on their annual self-assessment tax return.

There is no legal requirement for the company to have employees, as the director is allowed to run the company on their own - however, this is not the same as being 'self-employed'. For more on the differences between being self-employed and being the director of a limited company, please feel free to check out our article on 'Changing from a Sole Trader to a Limited Company'.

Are there any disadvantages to being a company of 1?

One of the main downsides is that all the work and responsibility falls on you as the only director of the company. You are required to manage the day to day running of the business, as well as ensuring that your company is up to date with all the annual filing requirements. This is where it may be useful to outsource some of your tasks to external companies, such as Easy Digital, who can help complete your returns for you.

We do actually offer a managed filing service, which is where one of our accounts specialists will complete and submit the returns for you, upon your approval - all that we need from you is a spreadsheet with the income and expenses during the accounting period, or, if you are unable to manage this, we also offer a book-keeping add-on where we will create this for you. We would complete your corporation tax return with full accounts for submission to HMRC, and also the annual accounts submission for Companies House. This service is popular with a lot of smaller companies who only have one person in it, as it relieves some of the pressure off them and allows them to focus on other areas of the business.

For more information on our managed filing service, please feel free to check out our website Easy Digital Tax.