What does AML mean?

AML is an acronym for Anti-Money Laundering. This refers to a set of laws, regulations and procedures intended to prevent the illegal generation of income, the disguising of the origin of money and funnelling illegal returns through financial systems in order to make them appear legitimate.

The current requirements in the UK are an evolution of several pieces of legislation that have been introduced over the years and are now covered by the 2002 Proceeds of Crime Act (POCA). The POCA act criminalises all forms of money laundering and creates offences concerning failure to report a suspicion of money laundering. The premise of POCA is that it constitutes what is criminal property and it enables the recovery of criminal assets.

What is an AML Check?

An AML Check is an identity verification procedure which is used to assess a company's customers associated risk with financial crime. This is done by confirming the customers identity via Proof of Name and Proof of Address. The aim of the check is to accurately identify an individual that are actively taking part in money laundering activities.

An AML check involves verifying the identity of the customers by requesting Proof of Address and Proof of Name and by assessing any risks they may pose.

Within an AML check you will be asked to provide the following, but not limited to, the following information:

- Your Full name

- Proof of Residential Address

- Date of Birth

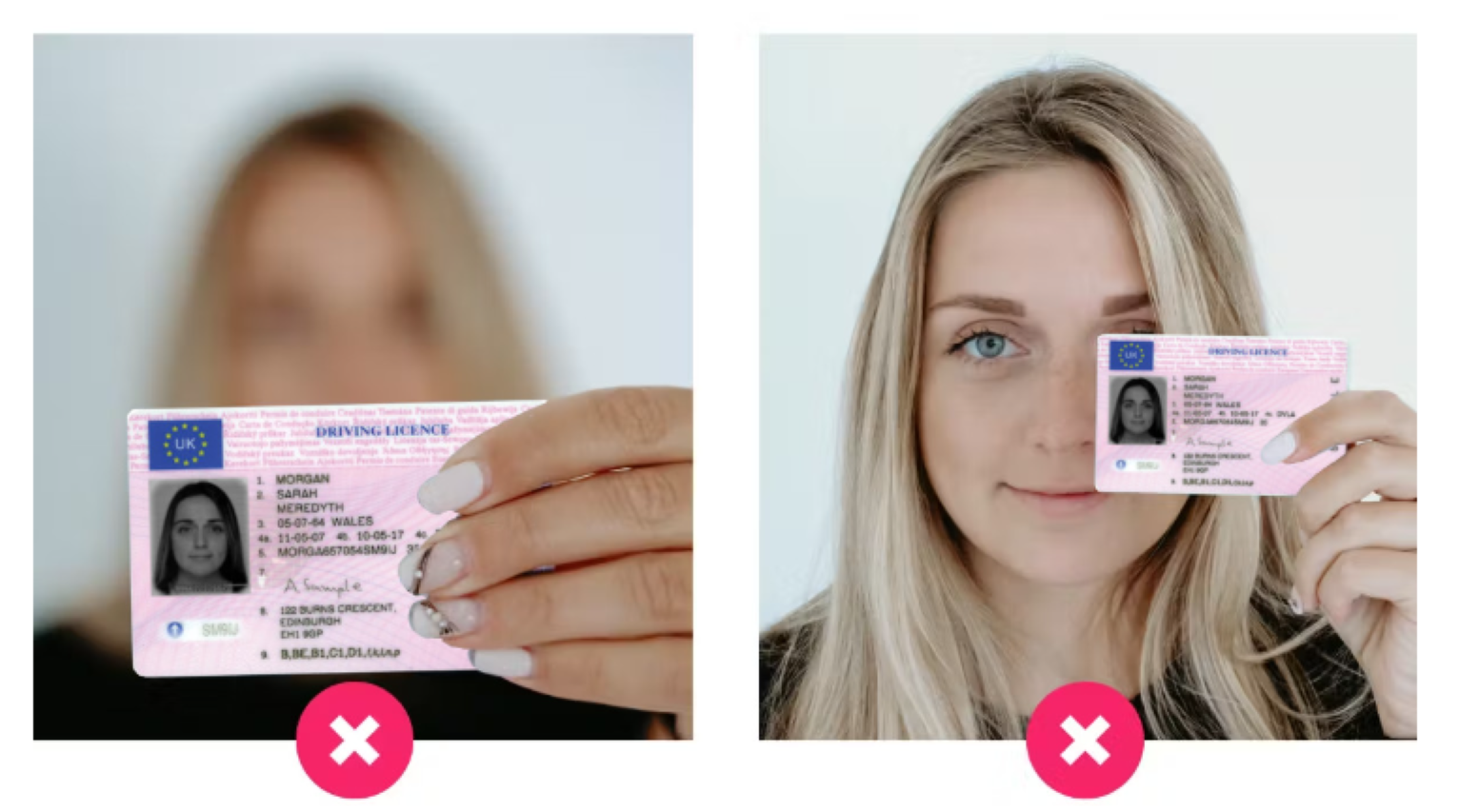

- A photograph of an official document with an image of yourself on it (Proof of Name) being held next to your face as shown in the exemplar photo below:

What do I need to provide when incorporating my company to pass my AML check with flying colours?

To pass your AML check when incorporating you are required to provide Proof of Identity. This is then further broken down into two further categories, these are Proof of Address and Proof of Name. You cannot use one form of identification as proof of both Name and Address.

You can find a list of the accepted forms of identification which can be used for Proof of Name as well as the documents which are accepted as Proof of Address below:

| Proof of Address | Proof of Name |

|

|

Please note some documents can be used as both Proof of Name and Address but if this document is used as evidence for Proof of Name it cannot also be used as evidence for Proof of Address. For example: You provide your Current UK drivers license as Proof of Name. Now you will need to submit any of the other accepted documents as part of Proof of Address, such as a Utility bill (gas electric, satellite television, landline phone bill) that was issued within the last 3 months.

Documents that we do NOT Accept are:

- Provisional driving licenses

- Mobile phone bills

- Credit card statements

How should I upload my documents?

If you want to start your new company using our Company Incorporation service then in this section I shall explain how to upload your documents after you have successfully purchased your incorporation, as well as any of our additional services that you may wish to purchase.

Step 1: Organise your documents that you want to upload

The first step for a smooth incorporation is to choose your documents that you plan on uploading as Proof of Name and Proof of Address. Please remember that these documents must be different as stated below the table with an example.

Step 2: Input the company's Directors / Officers details

Now that you have organised your documents you will need to input the required Director(s) details into the template. This includes the Director(s) date of birth, mobile number, place of birth and either their Passport number or their National Insurance number.

Step 3: Upload your Documents

Now that you have input all of the Directors / Officers details you now need to upload your documents. You can do this by clicking on the 'upload' within the brackets or by dragging the files into the box.

Step 4: Repeat for Second Director (when applicable)

If you wish to have a second Director / Officer for your company that you are incorporating, simply repeat the steps above again using their information and documentation.

When uploading your documents please ensure that all information on the document is clearly visible and is uploaded in one of the following formats: PNG, JPEG or PDF.

Step 5: Submit your Information for its AML check

Once you are happy that all the information input is correct and that you have uploaded your documentation in the correct format that is clearly visible, then submit your incorporation and we will review the information submitted. Once reviewed the incorporation will either be approved and submitted to Companies House or we will reject the submission and provide a reason for the rejection which can be rectified following the instructions provided.

Hopefully this article has proven itself interesting and has helped you understand what an AML check is and what it entails. If you have any other questions about incorporating a company please take a look through our Knowledge Base where you can find plenty of articles about different aspects of incorporating a company.