What Happens Directly After You Incorporate a Company?

Starting your own business is a very exciting step, you have probably spent months planning the road ahead. Once you have selected the name of the business and incorporated a company, you can start working through your plans that will hopefully lead to your success. However, there are a few requirements you need to be aware of whilst running a company to ensure you remain compliant.

Once you have incorporate a company with Companies House, all of your most important company information will be available on the Companies House website, including your Certificate of Incorporation and Memorandum and Articles of Association.

The following information will also be available on the company register and viewable for anyone searching for information about your small business:

• The company registration number

• Company Type – For Example ‘Private Limited by Shares’

• Date of Incorporation

• Company registered address

• Company officers

• Company Nature of Business and SIC code

Having all of this information to hand is necessary for maintaining your records, ensure your small business information is up-to-date, and keeping track of your key filing dates.

Your Company Information

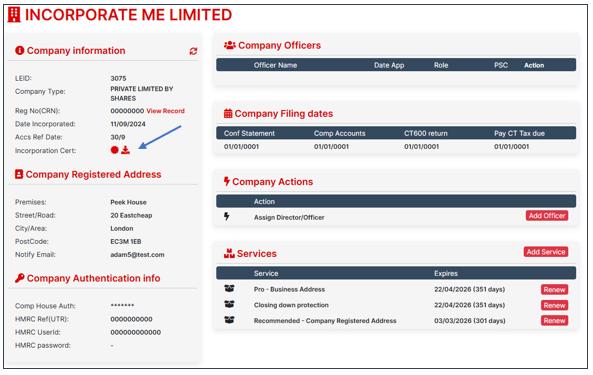

When you incorporate a company through Easy Digital Company, we take steps to make your life as a small business owner easier by emailing your Certificate of Incorporation and Memorandum and Articles of Association directly for you to keep for your records. When you login into your account, you can also view and be able to download them at any time from within your company dashboard next to ‘Incorporation Cert:’ in the left-hand menu:

To help make running a company easier, our quick reference dashboard (shown above) also includes all your information from Companies House in one place, so you can easily make changes to information under ‘Company Actions’, and stay on top of your submissions under ‘Company Filing Dates’.

Preparing for Your Filing Deadlines

After you incorporate a company, your company will be expected to comply with both Companies House and HMRC’s Annual filing requirements, which include the following as shown in the dashboard:

The following filing requirements need to be adhered to whilst running a company.

Companies House Annual Filings requirements:

• Confirmation Statement

• Company Accounts

HMRC Annual Filings requirements:

• CT600 (corporation tax) return

• Corporation tax (CT) payment

How long Before you have to File?

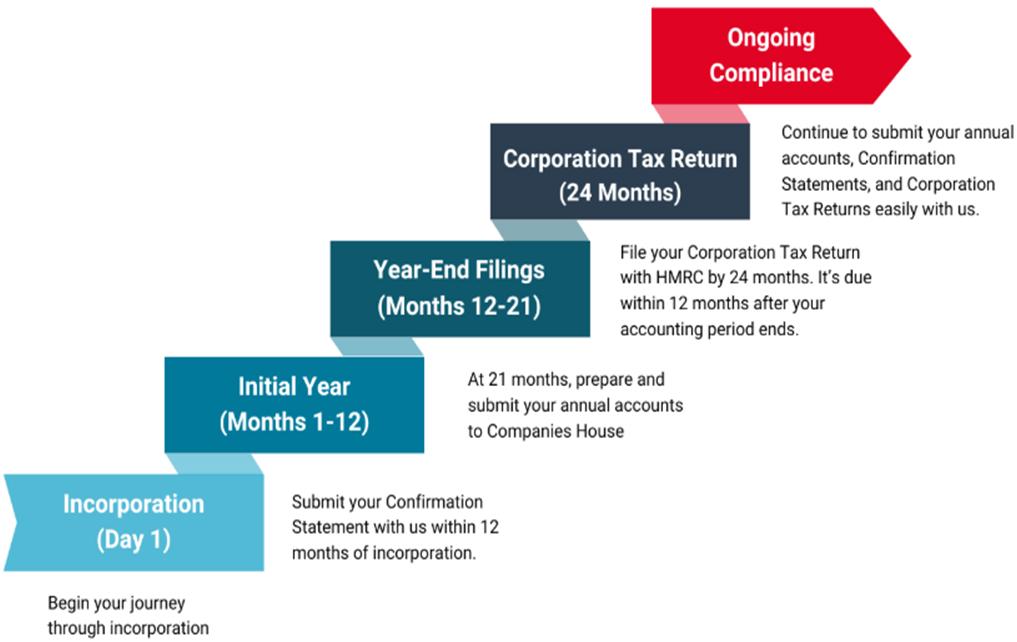

Your first filing after you incorporate a company will be the Confirmation Statement. Typically expected within 12 months and 14 days after your date of incorporation, it is used to confirm and update information such as the company registered address, company directors and principal activities of the business. If any of the other details that you need to check, such as Company address and director details are not up-to-date you will need to amend these before you file your confirmation statement.

Note that if you incorporate through Easy Digital Company, we can do the Confirmation Statement filing for you as an add on or included in our incorporation packages.

Next, your first Annual Accounts (year-end) filings will be due after 21 months of incorporation, and every 12 months thereafter, following the end of each accounting period. This filing records the company’s overall finances for their first accounting period which is reflected in a Balance Sheet within the company accounts.

Finally, your first Corporation Tax Return for HMRC is due 12 months after the end of your accounting period, and annually thereafter. You’ll also need to provide first year company accounts to HMRC, including both an Income Statement and a Balance Sheet that reflect the company’s financials for the period. You will need to file a corporation tax return with HMRC if you receive a notice to file from them after you incorporate a business. This is even if you are loss making, not started to trade or dormant. However, any corporation tax that is due will need to paid to HMRC by 9 months and 1 day of the end of your accounting period.

Note that you’ll probably submit 2 CT600 returns to cover an extended first year period, up to 24 months after your incorporation date.

This filing timeline shows you what you need to file whilst running a small business and when:

Click to enlarge:

As you can see there are several deadlines that you must comply whilst running a company. We also offer help with your tax filing services for small businesses via our sister site Easy Digital Filing

In a Nutshell…

That’s everything you need to file to Companies House and HMRC to fulfil your annual compliance requirements, and Easy Digital Company streamlines the process within our customer portal and on the Easy Digital Filing platform.

If you want to find out more about running a limited company, have a look through our Knowledge Base articles, or get in touch with us and we’ll be happy to help.