What is a Holding Company?

Legal Requirements

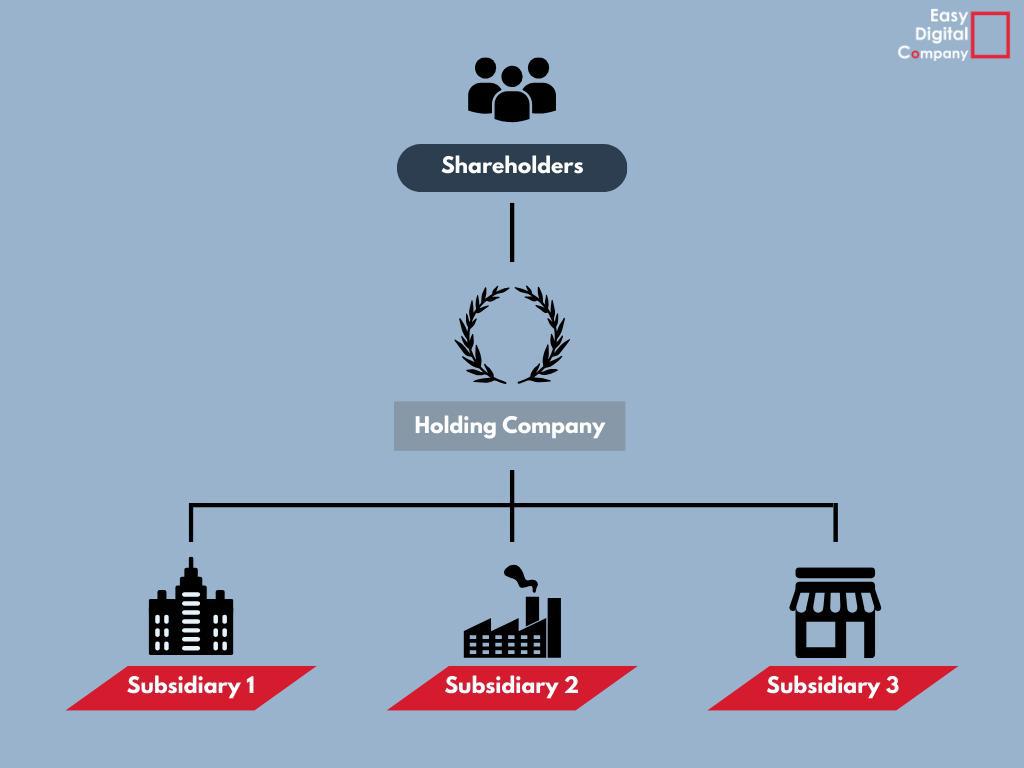

- Holding companies must own more than 50% of the voting rights within each of its subsidiaries.

- It is a member of the subsidiary company and has the right to remove a majority of its board directors.

- It is a member of the subsidiary company and controls the majority of the voting rights under an agreement with other shareholders.

Advantages of a Holding Company

Reduced Risk

Tax Benefits

- Holding Companies are able to move losses between their subsidiaries to reduce taxes for certain companies; for example, if one subsidiary owned by a holding company was loss making and another was profit making, the loss making company could move their losses to the profit making company to reduce their corporation tax.

- Another way that the holding company structure could reduce tax, is through the movement of dividends. - Dividends paid out from a subsidiary to it's holding company can often be exempt from corporation tax, so long as the transaction complies with the 'Dividend Exemption Rules', permitting for the subsidiary profits to be retained tax free.

Simple Set-Up

Potential Road Blocks

Although incorporating a holding company undoubtedly has some financial benefits, as with many things there may be a downside; registering a holding company can have some disadvantages, which are important for potential shareholders to be aware of:

Costs Involved

Setting up a holding company will involve some additional costs through the incorporation of the company itself, as well as administrative costs for managing the subsidiaries. However, with incorporation packages available from as little as £54.99 the long term benefits of owning a holding company are bound to outweigh up front incorporation fees.

Increased Complexity

Operating the holding company will of course, increase administration tasks for managing subsidiaries and create extra filing requirements for the holding company to submit the necessary documents to Companies House and HMRC as needed.

Conflicting Interests

Due to the holding company having whole or partial ownership of managing subsidiaries, potential conflicts may arise if the interests of the holding company differ from those of the subsidiary companies, which can work against them as the parent company always has more than 50% of the voting rights.

Redistribution of Shares

Typically, a holding company is set up to manage one subsidiary, which redistributes shares from the original company into the holding company. This could incur an additional tax bill for the new holding company, particularly if the shareholders change or multiple subsidiaries are added at the same time. As this is assessed on a case-by-case basis, the best way to find out your tax liability is to contact one of our account specialists for more information.

Registering a Holding Company

The process of registering a holding company is no different to any other limited company. Follow the steps below to set up a company quickly and easily with us: You can also find out more on the How it Works company guide.

- Find a Name

Choose a unique name using our company name checking tool, which updates in real time from Companies House.

- Select a Package

Choose from Essential, Recommended (with registered address) Pro, and Ultimate company incorporation. Check Our Prices

- Register your Details

You’ll need to enter the company and director addresses, your principal business activities, and an email address for Companies House.

- AML check

All Directors and Persons with Significant Control (PSC) will need to provide a photo ID document and proof of address for us to verify your details.

- Submit and view your company dashboard

While we get things ready, you’ll be able to check the status of your application in the company portal. We will also notify you by email once your incorporation has been approved.

That's all you need to do! We're always here if you have any questions, so don't hesitate to get in touch with the team, check out our Knowledge Base for more articles on company formation, or get started straight away with the company name checker.