While the circumstances of a company closure can often feel frustrating, the process of closing a company needn’t add to your woes. Read on to find out how to close a company simply, lawfully and (hopefully) painlessly.

Self-Managed Company Closure

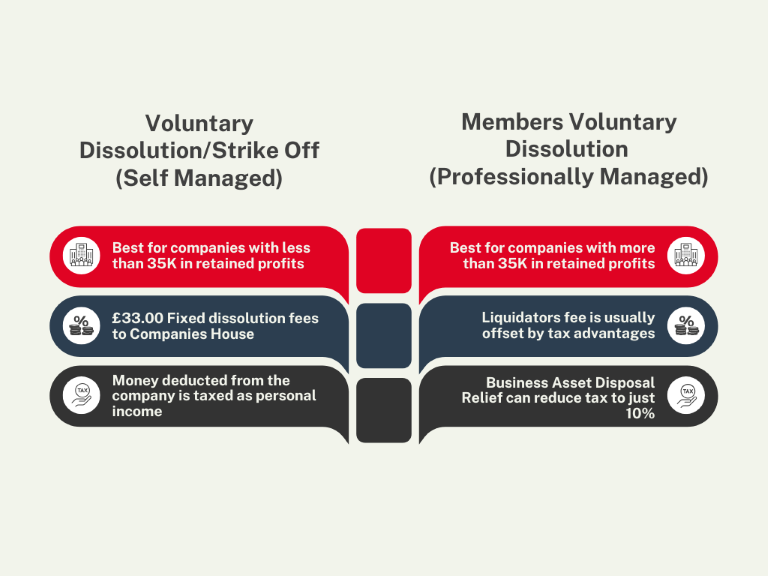

The most common option for businesses worth up to £35,000 in retained profits, a voluntary dissolution aka a (self-managed) strike off is an inexpensive and straightforward option for those small business owners who want to cut down on ‘red tape’ and manage the process themselves.

The director (or directors) must take out any revenue and/or company assets from the business before they apply for the strike off by submitting a DS01 form, which can be filled in online for a fixed fee of £33.00 or sent back by post with a cheque payable to companies House for £44.00. They must also not have traded or changed their company name within a 3-month timeframe, be involved in any legal proceedings concerning the business, or have sold any company owned property before they apply.

Professional Closure

Members Voluntary Liquidation (MVL) is another way to close a company with retained profits where the company closure is professionally managed by an insolvency practitioner (IP). MVL follows a formal liquidation process, selling company assets, settling any outstanding debts and distributing assets among shareholders. A final dissolution meeting is usually held between 3 and 6 months after the formal liquidation process has begun, before the company files its final accounts.

A professionally managed closure can take up to a year for more complex cases and cost upwards of £15,000, although most Insolvency practitioner’s typically charge between £3,000-£6,000 for small company closures.

There are a few points to take into account when deciding how to close down your solvent limited company, as there may be some potential implications for you as a director.

Financial aspects

If a company has minimal retained earnings or minimal assets to distribute to its shareholders, then at just £33 the Voluntary Dissolution may be the more cost-effective solution. However, if the company has retained profits of £35,000 or more than the MVL may be the better option, even after considering the liquidator’s fee.

Tax advantages

One of the main reasons for choosing MVL over voluntary dissolution is the taxation of funds extracted from the company. With the voluntary strike off – any money deducted from the company is treated as personal income, therefore, taxed at the corresponding rate of income tax. However, with an MVL all money taken during the liquidation process will be classified as capital gains. Due to the Business Asset Disposal relief the payable rate of Capital Gains tax can be reduced from 20% to 10%. The Business Asset Disposal relief (BADR) is a tax relief scheme that can lower the rate of Capital Gains Tax to 10% for qualifying gains up to a lifetime limit of £1 million upon liquidation of a solvent company.

Risks

Voluntary Dissolution can be a bit riskier than the MVL as the dissolution process is managed by yourself, therefore, you will need to ensure that all funds are distributed lawfully, and all outstanding liabilities are settled. On the other hand, with the MVL a licensed professional will oversee and ensure that all statutory duties are fulfilled.

In this article we focus on closing a limited company that has retained revenue at the time of closure. If you want to find out about closing an insolvent company, see this related article from our knowledge base https://easydigitalcompany.com/kb/closing-down-a-limited-company

We help businesses at every stage

Easy Digital Company helps small and micro companies open for business, but we also support our existing clients if they do need to close by making the process as smooth and straightforward as possible. If you want to find out more about how we can support your business goals visit Easy Digital Company or contact us and we’ll be happy to assist you.