The certificate of incorporation is a document that is issued by Companies House when a Company incorporates and becomes a registered business. The document will be received by the directors of the Company and contain important information that they may need in order to complete their returns later on – which is what this article will discuss.

When and where do I receive my certificate of incorporation?

As soon as your company incorporation is received and accepted by Companies House, you will be issued a certificate of incorporation, which is proof that your business has successfully been incorporated as a limited company.

If registering directly through

Companies House online, you could receive a digital PDF version of the document within anywhere from 3 to 6 working hours of your application being submitted. However, if you incorporate a company by post, which is where you fill out the paper forms and send them to Companies House, then the whole process of becoming registered and receiving your certificate of incorporation is much longer and could take around 8 to 10 days.

If you have incorporate a company through a formation agent, your certificate of incorporation will be sent to them, either digitally or by mail. Either way, the formation agent will forward the certificate to you, although the whole process of receiving your certificate may take longer, once again, if it is sent in paper form.

What information is on my certificate of incorporation?

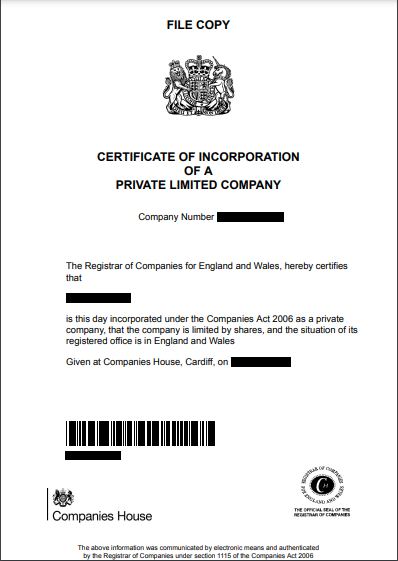

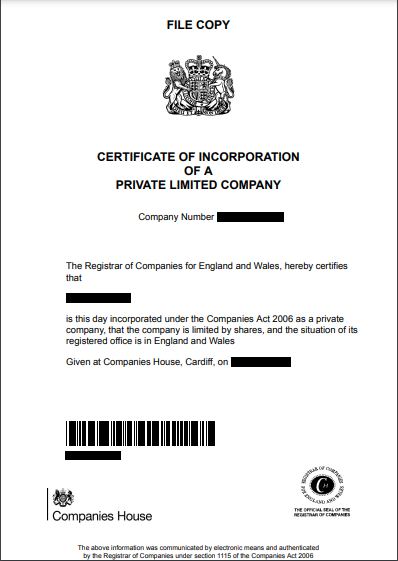

The certificate of incorporation states that the Registrar of Companies certifies that your company has been successfully incorporated. It is a 1-page official document issued by

Companies House and includes the Company Number, the Company Name, the date that the company was registered, along with a statement certifying that the company was incorporated on that day under the Companies Act 2006. It also states what type of company it is, such as a private company limited by shares, etc. Here is an example of what a

Certificate of Incorporation may look like:

You can find the full certificate of incorporation online in the Filing History section of your company's page on the Companies House website, which includes the application submitted to Companies House for the company to be registered with them. Information included on this is the full name of the company, the type of company it is, the situation of the registered office, the proposed registered office address, the company registration number, and the sic codes (which classify what type of industry or industries that your company is operating in).

It also includes information about the company’s proposed officers, who are the directors and secretaries, and any persons with significant control (PSC’s), these are the details you provide when your incorporate a company. They also contains the officers’ position, the type of officer (person or company), their full name (including first and last names), their service address, the country or state they are a usual resident in, their date of birth, and nationality.

In terms of PSC’s, the document includes their names, the country they are usually resident in, their date of birth, their nationality, and the nature of their control. Nature of control will explain what percentage (at least 25%) of shares or voting rights the person with significant control has in the company, and whether they have any rights to appoint or remove any members of the board of directors.

The document also contains information about the initial shareholders, which includes the share holders' names, addresses, class of shares, number of shares, the nominal value per share, and then the amount of shares both paid and unpaid by that person. Again this is information that is given when you incorporate a company. This is useful information to know when completing the abridged accounts for the Companies House annual submissions as you will need to make a note of the paid and unpaid share capital on your company’s balance sheet.

What do I receive once I have incorporated my company?

Once your application has been accepted and your company becomes registered with Companies House, not only will you receive the certificate of incorporation, but you also receive incorporation documents. These documents vary depending on whether you incorporate a company yourself or whether you used a formation agent. These company incorporation documents may include the certificate of incorporation, the memorandum of association, the articles of association, the share or guarantor certificates, depending on what you set your company up as, or an LLP agreement, if you have registered as an LLP. We've covered what is included in the certificate of incorporation, however, here is what is included in the other company incorporation documents:

Memorandum of association:

- This is a legal statement which the shareholders or guarantors are required to sign and states that they have agreed to form the company under the Companies Act 2006, agree to become a member of the company, and they agree to take at least one share in the company if it is limited by shares.

- If you sent your application to Companies House by post, you may be required to sign a paper version of this document as well once your application is accepted. This is the same for the Articles of Association.

Articles of association:

- This document outlines the specific rules relating to managing and running the company.

- Companies House have a selection of model articles, for the different types of companies (limited by shares, guarantee, etc.), and you are expected to select the one applicable to your company and include it in your application to register as a company.

Share or guarantor certificates:

- This is not a required company incorporation document sent by Companies House but some formation agents will send you share or guarantor certificates which outline the company information, the shareholders' name and address, how many shares they have in the company, and the nominal value of each share.

- The guarantor certificate has similar information on, however, instead of showing shares, it shows the amount of guarantee.

The most important document, however, is the certificate of incorporation as it formally states that your company is officially registered!

What happens if I need to replace my certificate of incorporation?

Your company’s certificate of incorporation should be available to view online at Companies House under ‘Filing History’, so if you cannot find the document you can access it here. This is the case for both paper and digital versions of the company incorporation document as they will both be uploaded as PDF format on the website. If you used a formation agent, you can request a document through them and they will be able to send you a new one. Furthermore, if you need to request a new certified document for specific purposes, then you can order a new one from the Companies House website on your company’s page under the ‘More’ section. Certificates cost £15 for a standard dispatch or £50 for an express dispatch, whereas certified documents cost £15 per document or £30 for the incorporation package standard dispatch, and £50 or £100 for the express dispatch.

So, what do I use it for?

The certificate of incorporation includes many details about your company which you may need to refer to when completing business related activities following company incorporation. This might include when opening a business bank account, applying for a business loan, buying or leasing property in your company’s name, applying for business grants, seeking investments, bringing in new shareholders, selling or dissolving your company, and more. You will likely need to provide you company registration number when attempting to complete any of these actions, and this can be found on your certificate of incorporation.

Hopefully, after reading this article you will have a better idea of what a certificate of incorporation is and how it can be useful to you in the future!

This article is information only and has been prepared for general guidance on matters of interest only, and does not constitute legal, accounting, tax, investment or other professional advice or services. You should not act upon the information contained in this article without obtaining specific professional or legal advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this article, and, to the extent permitted by law, Comdal Limited, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.