Have you ever wondered what returns you should make if your company has not been trading since its incorporation? Continue reading to get to know the main points to take into account when it comes to filing returns if your company has not been trading.

What happens after a company's incorporation?

When a limited company is incorporated, Companies House automatically informs HMRC about the existence of the Company. However, no further details are passed between the two authorities in terms of whether the company is trading, non-trading or dormant. Hence, HMRC assumes that the company is trading from its date of incorporation, unless informed otherwise or unless your company is noted as dormant at the time of incorporation. This is why the filing requirements to Companies House and HMRC can differ depending on your company’s situation.

It is the responsibility of the company’s directors to inform Companies House and HMRC of changes to the company’s trading status.

Let’s start by taking a look at the differences between non-trading and dormant companies

Non-trading companies are inactive companies that can conduct certain financial activities, for instance - paying bank fees or any other transactions that may still be required due to the business arrangements that were established before the company paused trading.

If your company is a non-trading company – you will need to make company returns to both Companies House and HMRC. Companies House will expect the company return to include a Balance sheet, and HMRC will expect the company’s CT600 return accompanied by full set of accounts (Income statement and Balance sheet).

Dormant companies, on the other hand, are not carrying any kind of business activity – meaning that there are no business incomings and outgoings. Companies can either be dormant from their incorporation or dormant after a trading period. A dormant company will only need to submit a set of dormant accounts to Companies House for their Company Return along with their annual confirmation statement. Unless they have received a notice to file to HMRC, they will not need to file to HMRC. Companies that have trade and then become dormant will still receive a notice to file a CT600 company return to HMRC, unless HMRC have bee informed that the company is now dormant. You can tell HMRC your company is dormant online.

What do HMRC and Companies House consider as dormant?

Dormant is a term that HMRC and Companies House use for a company that is not active, trading or carrying on business activity.

For HMRC dormant companies are not active, not liable for Corporation tax or not within the charge to Corporation tax, for example:

• A new company that is not yet trading

• An existing company that has been but is not currently trading

• A company that will never be trading because it has been formed to own an asset

According to Companies House a company is dormant if it had no significant transactions within its financial year. 'Significant transactions' include all forms of income and expenses, apart from:

- Filing fees paid to Companies House

- Penalties for late filing of annual accounts

- Money paid for shares when the company was incorporated

It is important to note that even if your company is dormant for corporation tax purposes, you will still need to submit dormant accounts to Companies House each year. Contrarily, once informed of the dormant status of a company HMRC will not expect CT600 (corporation tax) company return to be submitted, unless a further notice to deliver a CT600 Return has been received.

When your company or organisation has not yet started trading

HMRC considers that your company or organisation has not yet become active or started trading if it has not yet engaged in any business activity, such as carrying on a trade, or buying and selling goods or services with an intention to make a profit. Your newly-formed company may not be active for Corporation Tax purposes for some months after you have incorporated your business. However, you may still carry out activities (pre-trading activities) or incur costs (pre-trading expenditure) before you officially open your business without HMRC deeming that you have started trading.

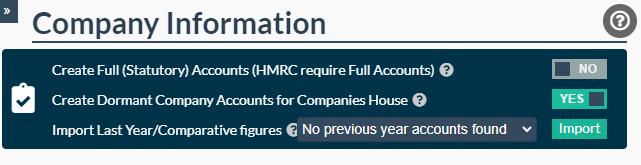

You can easily create dormant company account in our software. Once you have created your accounts and Companies House submission you will need to select dormant accounts on the company information page and complete the balance sheet:

Guide to company returns filing requirements for Non-trading vs Dormant companies

| Non-trading company | Dormant company |

| File accounts to Companies House within 9 months of the company’s accounting period end date | File dormant accounts to Companies House within 9 months of the company’s accounting period end date |

| File CT600 company return and accounts to HMRC within 12 months of the company’s accounting period end date | |

| File Confirmation Statement to Companies House | File Confirmation Statement to Companies House |

*If HMRC send you a "Notice to deliver a Corporation Tax Return" before you have informed them, you must submit a CT600 company return, through which you will inform them of the company’s dormant status.

Do I need to inform Companies House and HMRC that I have re-started my trading activity?

You do not need to inform Companies House if you restart trading, as the next set of non-dormant accounts that you file will indicate that your company is no longer dormant. However, you must tell HMRC within 3 months of starting your accounting period if your company is within the charge of Corporation Tax and is now active.