Starting your own business is an exciting venture, however, it is important to be prepared beforehand, so that your new company can succeed. Depending on what type of business you want to start up, you may need to think about finding an office space, hiring employees, setting up business insurance, setting up a website, etc., before actually starting to trade.

When starting your own business, one of the most important things you should have is capital - in other words, money! In order to make money, you first need to invest it into your company. You can't start your own business from nothing, as you need to have the necessary tools to be able to grow it and allow it to run.

How much money do I need?

Typically, a general rule of thumb for starting your own business is that you should have 3 months worth of estimated expenses, so that you can give yourself some time to set the company up, gain clients, etc., in order to keep it running before actually earning any income. If you are unsure what three months worth of expenses might look like, then a good starting point would be starting with an investment of around £5,000. This should cover some of the most basic start up expenses, such as equipment costs, basic utilities like broadband, electricity, professional costs such as registration fees or website creation, or even office supplies like computers or desks.

How do I plan for costs?

Once you have decided what type of business you want to start and have come up with a plan for it, a good starting point is to create a list of start up costs that you believe are applicable to your business. Doing some research on how much each of these costs will roughly be is useful when creating a budget for your company.

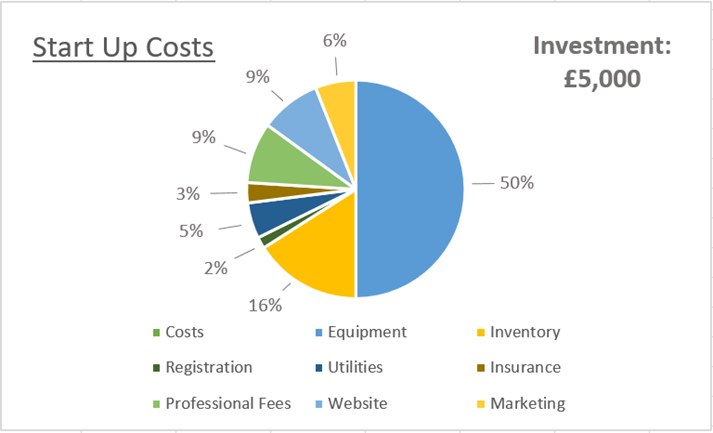

Having a budget will help you keep track of your costs to ensure that you are not overspending the initial investment. Here is a general idea of how your start up costs might be split, based on an start up investment of £5,000:

This is just one example of the costs of starting your own business, but how you split up your costs is depending on the type of company you want to start up, whether you work from home, how much you choose to do yourself, etc. As an example, here is a rough idea of a start up budget that you might have for the first three months:

- Equipment: £2,500 - this includes any physical equipment you might need, such as desks, computers, printers, any machinery, etc.

- Inventory: £800 - if your company is selling goods, for example, then you will need to have stock in order to begin trading.

- Registration: £85 - this would include the fee for incorporating your company, or setting up a registered address, etc. If you choose to incorporate your company through Easy Digital Company, we offer different bundles which could include the incorporation itself, the registered address, or even closing down protection (if you no longer require your company) all in one! Just head over to our pricing page to find out more - and keep your eye out as we often have special offers running!

- Utilities: £265 - this might include broadband/internet, electricity bills, or even phone bills.

- Insurance: £150 - this would typically be for business insurance, which can help protect your business as its growing. For more on the different types of business insurance you can get, please feel free to check out our article 'Do I need business insurance for my small company?' on our Knowledge Base.

- Professional Fees: £450 - this might include any legal costs, or accountancy fees, such as if you are using book-keeping software to keep track of your company's finances, or even setting up a business bank account.

- Website: £450 - this would include the designing and setting up a website, the domain, or even the monthly cost of keeping the website running.

- Marketing: £300 - this might include branding, such as creating a logo, or setting up any social media campaigns, advertisements, etc., to help get some visibility for your company.

How to minimise costs when starting your own business:

There are many different ways that you can try to minimise costs and make your investment go further when starting your own business. One of the easiest ways to cut costs is by working from home. While there may be added expenses when working out of your own home, such as extra broadband/internet, or more office supplies, you have the benefit of not paying additional rent for a separate office space.

Another opportunity to minimise costs when starting your own business is by opting for low-cost alternatives that will help you get your business off the ground. This could be buying second-hand equipment, rather than new, or choosing to create your own website using website creators, such as Wix or Squarespace, rather than hiring a website designer. Adopting a 'Do It Yourself' attitude will help you to minimise costs, however, it does mean that there will be a much larger workload to deal with during an already potentially stressful time of your start up.

It is important to remember that these things aren't necessarily permanent - you just have to start somewhere! For example, you may work from home for now, but once your start up grows, you could begin renting an office space and hiring more employees. Or, if you buy second-hand equipment now, it doesn't mean that you can't upgrade to purchase new materials, once the business has settled into trading.

Now that you have some information about the investment you will need to starting your own business, you should feel more confident when getting started! For more information about other aspects of being a start up, please see our knowledge base.