What are dividends?

Before we talk about how often you can pay out dividends, let's talk about what they are! Dividends are considered as a distribution of the company's profits to its shareholders or directors. This is typically in the form of money (or cash), but it could also be considered as stock. Typically, with smaller companies, dividends are simply a cash pay out to its directors (who are often also the shareholders).

Dividends should only be paid out if the company has made a profit, and typically are also not paid out unless the company's capital and reserves figure is positive - as dividend pay outs affect the company's balance sheet.

How often can I pay out dividends?

There is no set schedule for when you must pay out the dividends - this can be done at any time. So, the payments are at the discretion of the directors, or board of directors, and are made when they decide to make them. There are typical times, however, when companies would pay out the dividends - for example, quarterly (at the end of each quarter), or bi annually (which would be every six months). If you were to split the payments up into quarters, they would be paid on the 31st March, 30th June, 30th September, and 31st December, which are the dates for the end of each quarter. Then, for bi annual payments, these would typically be made on the 30th June and 31st December each year.

You may choose to pay yourself dividends, rather than being paid a salary by the company - in which case, you may wish to be paid monthly instead. Again, it is completely up to the directors when they want the payments to be made. There are no laws or legal requirements regarding the issuing of dividends on a set payment plan or date, etc.

It is important to keep note of the dates of your company's accounting period, as you will need to reflect the total number of dividends that were taken during that period, rather than per the financial year. These will then have to be accounted for on the company's balance sheet for the period, and then you will also need to note this on your personal self-assessment tax return.

How much dividend can I pay myself?

There is no limit regarding the total number of dividends you can pay out either within the period or over time, however, it should not exceed the company's total profits as this would not reflect well on the company. Furthermore, as previously mentioned, you should not take out more dividends than the amount of capital and reserves that the company has (when positive), as it reflects negatively on the company if this brings its balance sheet into a negative status. Even if there is money in the company’s bank account, the company could still have made a loss, so it is important to stay up to date with the incomings and outgoings of the business so that you are taking dividends out correctly.

How much dividend can I pay myself tax free

Taking out dividends does not affect the company’s taxes in any way – as they are only reflected on the balance sheet, rather than on the income statement, which would then affect the company’s taxable profit. Many people may believe that as the money was taken out of the company, that it would then be considered as an expense, however, this is not the case. If there are any employees who are paid by the company through PAYE, then this would be considered as an allowable expense for the company.

While there is not much of a benefit for the company when taking out dividends, as it does not help reduce the tax due, etc., there is sometimes a personal tax benefit, since the tax rates for dividends are lower than they are for income tax. The tax rate that you are charged at on dividends is based on the tax band that you are in for income tax.

So, there are three tax bands that you are charged at for income tax, which are the basic rate, the higher rate, and the additional rate. To determine which band you fall in, you need to include any income you have taken and also any dividends you have received. The income and dividends are charged at different rates, but still need to be considered as one income when determining the tax band rate.

The varying tax rates are shown below:

| Band | Taxable Income | Income Tax Rate | Dividend Tax Rate |

| Personal Allowance | £12,570 (for income tax) and £500 (for dividends) | 0% | 0% |

| Basic Rate | £12,571 to £50,270 | 20% | 8.75% |

| Higher Rate | £50,271 to £125,140 | 40% | 33.75% |

| Additional Rate | £125,140 and over | 45% | 39.35% |

For more on different tax rates, please feel free to check out our article ‘Corporation Tax vs Dividend Tax: A Detailed Comparison for Businesses’.

How do I reflect dividends in my accounts?

Dividends need to be reflected in the capital and reserves figure in your company’s balance sheet. Depending on which financial reporting standard you are filing under, where you place the dividends may differ. If you choose to file through our software, we offer filing services for companies wishing to file under either the Financial Reporting Standard 105 or the Financial Reporting Standard 102.

Here is how to account for dividends when filing through Easy Digital Filing.

Micro Companies (FRS 105):

Micro companies can file under the Financial Reporting Standard 105 – which is a less detailed reporting standard as it does not show a breakdown of the capital and reserves figure, compared to other reporting standards. You will need to calculate the figure manually, before entering it into the filing template.

The calculation for the capital and reserves figure is as follows:

Capital and reserves from previous period + net profit/loss from this period – dividends taken this period = capital and reserves for this period.

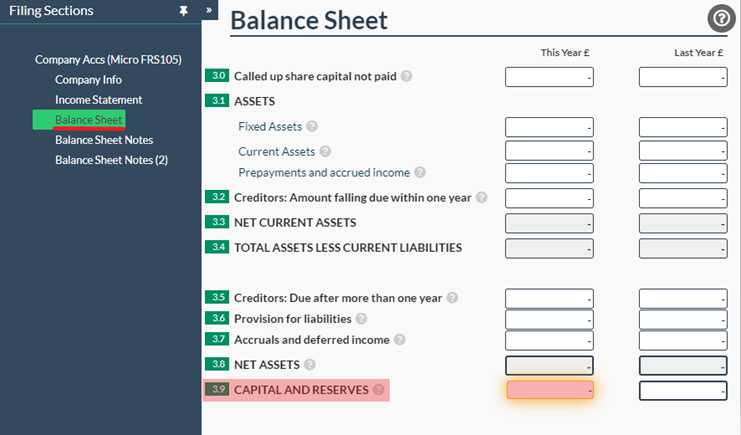

You will be able to find the capital and reserves figure by opening the Micro Company IXBRL Accounts template, clicking on the ‘Balance Sheet’ tab, and then entering the figure into box 3.9.

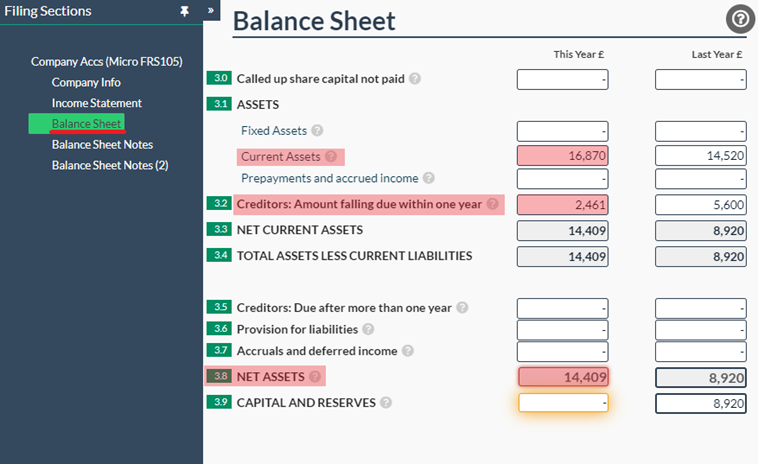

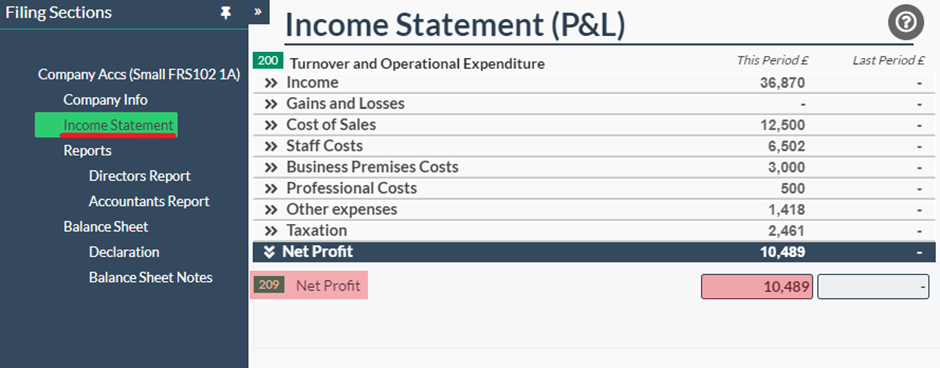

In this example, we will assume that there is a trading company which has a net profit of £10,489, cash at bank at the end of the period of £24,770, creditors due of £2,461, and took dividends of £5,000 during the period.

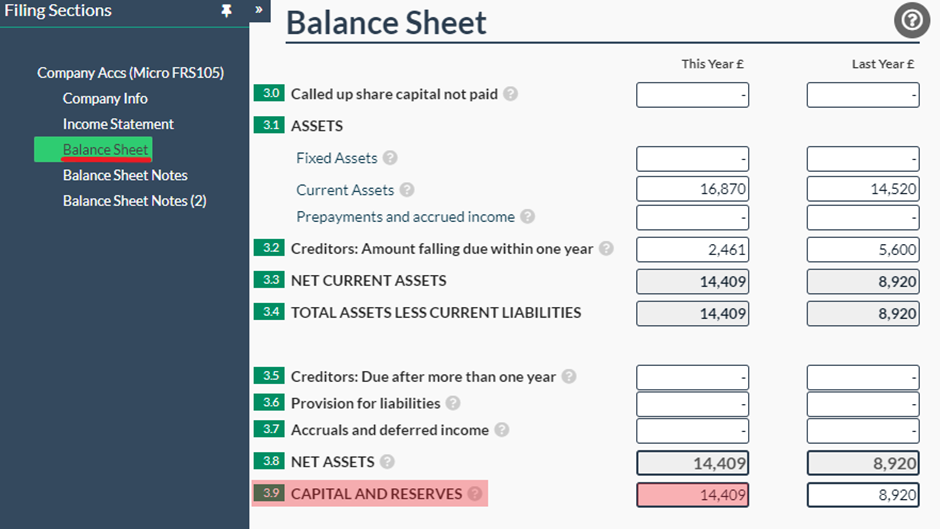

The balance sheet should then be populated as follows:

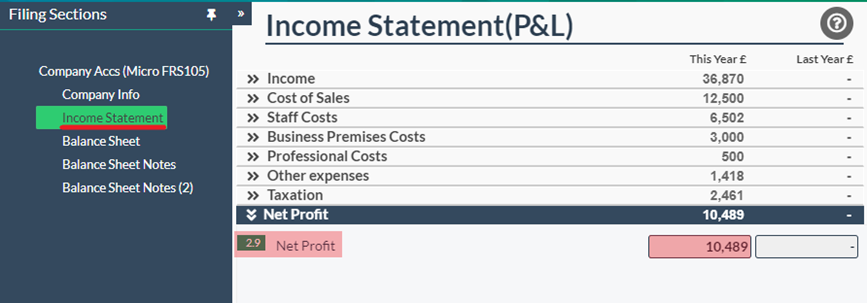

To calculate the capital and reserves figure, you will need to find the net profit figure from the income statement.

Using this figure, you can then add the previous year’s capital and reserves (which is £8,920) to this period’s net profit (which is £10,489) and then subtract the dividends taken (which is £5,000). This means that the capital and reserves figure for this period is £22,309 – which matches the net profit.

You will then need to enter this figure into box 3.9 on the balance sheet.

Small Companies (FRS 102):

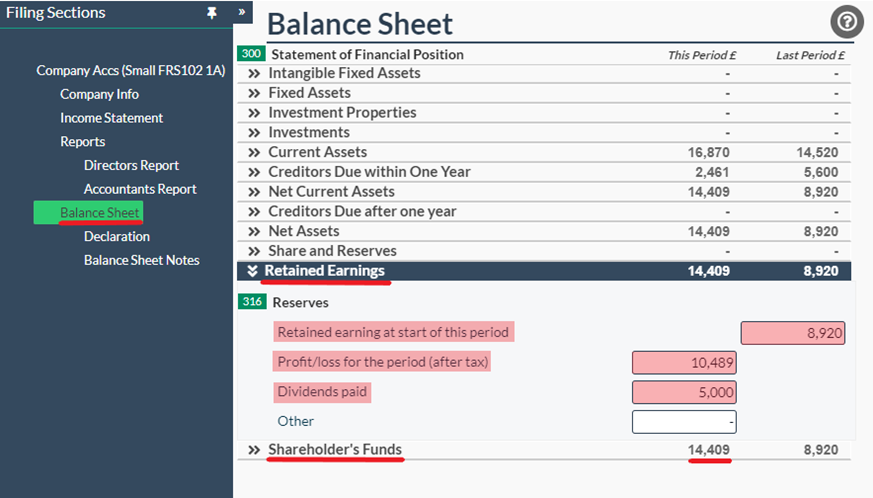

When filing under the Financial Reporting Standard 102, you are able to provide a more detailed breakdown of the figures in both the income statement and the balance sheet. This means that there are separate boxes for dividends, share capital, etc, when completing the balance sheet. Also, instead of being reflected in the capital and reserves figure, the dividends are used to calculate the ‘Shareholder’s Funds’.

For more on the different filing requirements for the different Financial Reporting Standards, please feel free to check out our article ‘Changing company size – micro vs small’ on our Knowledge Base.

For this example, we will just assume that the previous micro entity is choosing to file as a small entity instead, so will use the same figures for completing the small accounts.

Again, you need to complete the income statement first, to ensure that you have the correct net profit figure for completing the balance sheet.

Then, you can enter the necessary figures into the balance sheet, and the software will automatically calculate the ‘Shareholder’s Funds’ based on those entries. In box 316 in the balance sheet (under ‘Retained Earnings’), you can enter the capital and reserves figure from the previous period, the net profit for this period, and the dividends paid in this period, all into the appropriate boxes in the template. Like below:

Instead of having to calculate the figure yourself, the software will automatically calculate and populate the ‘Shareholder’s Funds’ box for you.

Dividends for Directors:

After reading this article, you should now feel confident when dealing with dividends, whether it is understanding when they can be paid out, or how to reflect them in your company accounts. Here are some of the key points to remember:

- Dividends should not be reflected in the income statement (as they are not an allowable expense) – only in the balance sheet.

- Micro accounts (FRS 105):

- There is no separate section for dividends, but these need to be reflected in the capital and reserves figure.

- The capital and reserves are not automatically calculated, so this figure needs to be manually calculated and entered into the balance sheet.

- Small accounts (FRS 102):

- Instead of being reflected in the capital and reserves, the dividends are reflected in the 'Shareholder's Funds' figure.

- The shareholder's funds are automatically calculated for you, so you just need to enter the previous periods shareholder funds figure, this periods' net profit figure, and then the dividends that were taken, into each of the appropriate boxes on the balance sheet.

If you are still struggling to complete your filings, we also offer a managed filing service – where we complete and submit them for you! For more information on this, please feel free to head to Easy Digital Tax.