Annually, companies are required to submit numerous filings to different legal bodies. This can be confusing and lead business owners to believe they have submitted all the required filings, only to receive a penalty charge from HMRC to their registered address for a missed or incorrect filing. This adds another layer of stress to running a business, which can be easily avoided if given the correct information. In the following paragraphs, you will read about the different types of filings that a Limited Company must submit and to which legal body each filing must be submitted to, avoiding penalties and ensuring a smooth filing process.

Annual Accounts - Submitted to Companies House Annually

Companies House require annual accounts to be submitted once per year. Currently, companies which fall under Companies House's criteria for a Micro and Small Company can choose to file Abridged Accounts. This is the format in which a company only discloses the Balance Sheet within their Annual Accounts submitted to Companies House.

We should note that this is due to change as stated in the Economic Crime and Corporate Transparency Act (ECCTA) which was released in October 2023, although the exact date for when Micro and Small companies are unable to file Abridged accounts is yet to be confirmed, you can stay up to date with the changes to the Economic Crime and Transparency Act

These accounts are submitted once a year whether the company is dormant or active. You can find out when a company's accounts need to be made up until and when the accounts are due by on the company's Companies House page, simply input the company name, click on the relevant company and then you will be able to see the dates for filing to Companies House as well any previous years submissions.

If you are looking to file your Companies House Accounts you can do so using our quick and easy-to-use software. Create an account for free today to try it out.

Confirmation Statement - Submitted to Companies House Annually

A business must file a Confirmation Statement once a year. The Confirmation Statement is where limited company's must confirm that their basic company information (registered office, officers, description of business etc) is correct and up to date or update the information if anything has changed.

The due dates for your Confirmation statements can be found on a company's Companies House page next to where you can find your accounting due dates. A company's director will need to submit the confirmation statement within 14 days of this submission date, for example if your confirmation date is 1 February 2024 you will have until 15 February 2024 to file the Confirmation Statement.

If you wish to find out more about Confirmation Statements, please feel free to read our article What is a Confirmation Statement? In this article you can find out in further details about what information is required when filing your Confirmation Statement. You can File a company's Confirmation Statement by using Easy Digital Filing Software or using using Companies House website.

Corporation Tax Return Submission - Submitted to HMRC Annually

The CT600 is required to be submitted to HMRC once a year, the CT600 is the company's Corporation tax return. The purpose of the CT600 is to calculate the Corporation tax that is owed to HMRC.

When HMRC require a CT600 to be filed they will also send a 'Notice to Deliver a Company Tax Return' to the company's registered address. On this document you will find the dates that HMRC require you to make up your accounts from and to.

When filing the CT600, for most Companies, HMRC require the filing of full IXBRL tagged accounts (complete Income Statement, also known as a Profit & Loss statement, and Balance sheet) alongside the CT600 submission. IXBRL is a computer tagging language that HMRC require the accounts to be completed and submitted in. If the filing is not completed in this format, HMRC may reject the filing. If you use our tax filing software our accounts are fully tagged already.

Also be aware that if your company is filing for an extended accounting period (longer than 12 Months), which is usually the case when a company files its first tax return, a second CT600 is required to file for the full extended period. This is because the CT600 filing can only be used to file for a 12 Month period, any periods longer than that will require a second CT600 for the remaining days left in the accounting period.

If you are looking to file your CT600 you can submit this using our software. You can create an account for free today.

PAYE Return (Full Payment Submission) - Submitted to HMRC Monthly or Quarterly

A PAYE return is typically done using a payroll software. This is because HMRC requires companies to report their PAYE information online unless they're exempt. If you are planning on incorporating a company or are simply looking for new payroll software, you can find all HMRC recognised payroll software's here - a company can use any of the software's on this list to report PAYE to HMRC.

If a company runs payroll itself, the payroll software will work out how much tax and National Insurance is owed including the employer's National Insurance contribution on each employees earning over £242 per week.

Payroll software can also submit a company's Full Payment Submission (FPS) to HMRC. A company must submit their Full Payment Submission on or before their employees' payday, even if the company pays HMRC quarterly instead of monthly. Within the FPS a company must inform HMRC about payments and deductions made to employees every time they are paid.

When it comes to paying HMRC, the company can view what it owes HMRC based on the payroll reports; a company can also view how much they owe through its HMRC Online account (Government Gateway). Once they know how much is owed they have to pay HMRC usually every month through the company's Government Gateway account.

However, if the company is a small employer that expects to pay less than £1,500 a month, they can arrange to pay quarterly. To do this, the company must contact HMRC's payment enquiry helpline.

VAT Return - Submitted to HMRC Monthly or Quarterly

HMRC require all VAT registered companies to submit a VAT return every 3 Months, even if they do not have any VAT to pay or reclaim. Although, once a company has a net VAT liability of over £2.3 million in a 12 Month period they are automatically required to submit a VAT return monthly. Net VAT liability is calculated as: if the output tax is greater than the input tax, then the Net amount is to be paid by the company and is the Net VAT liability.

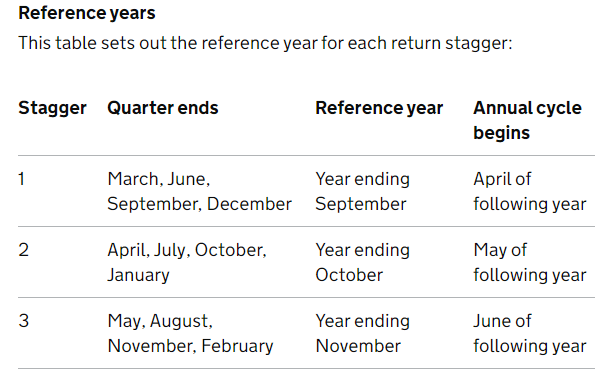

When making your filing you need to be aware of which return 'Stagger' the company must comply with and when your quarters end depending on the 'Stagger' it is in. Below are the different possible 'Staggers', however, if you are unsure which stagger you need to comply with you should call HMRC directly to confirm.

HMRC have a guidance package about 'How to fill in and submit your VAT Return'. This guidance sheet explains the common VAT terms and includes a helpful guide to completing the VAT return.

Hopefully this article has helped with the confusion of which filings a limited company must make each year and which legal body the filing must be submitted to. If you wish to carry on reading please dive into our Knowledge Base which has plenty of articles which can range from What is a Balance sheet? to Capital Allowances.