What is a SIC Code?

A Standard Industrial Classification code, more commonly referred to as a SIC code, is a five-digit code that specifies your business’s activity. They describe what your company trades and sells to customers.

For example, if a company has a SIC code of 47240 this would mean that their business's activity is a bakery (retail sale of bread, cakes and confectionary products).

The SIC code system has been used in the UK since the 1940’s and has evolved with new industries and sectors emerging. The current version of the SIC code system is called SIC 2007 which has over 700 individual SIC codes. You can find a full list of SIC codes on the

Companies House website. SIC 2007 provides a more detailed classification of a business’s activity which can help identify your company’s industry and connect with the right potential customers.

Why are they needed?

When you decide to incorporate a company, you’ll need to

incorporate through a formation agent or complete the IN01 form at Companies House.

Companies House is government body in the UK that is responsible for incorporating, maintaining and dissolving companies. One section you are required to fill out is the ‘Principal Business Activity’. This is where you need to put your company’s SIC code to tell Companies House what the intended activity of the company will be. Even if you are incorporating a company as a dormant (99999) or non-trading company (74990), you are still required to supply a SIC code. If your company provides a range of different trades or goods, you are allowed to list up to four SIC codes.

- Gain an insight into the types of businesses operating in the UK at any time

- See which industries are growing or in decline

- Keep track of trends to gain a better understanding of the UK’s economy

Other organisations use this data too. Insurers, banks and creditors use SIC codes to help determine the level of risk a business holds based on the industry that business operates in.

Please note, if you incorporate a company as a limited liability partnerships (LLPs) do not need to provide a SIC Code when registering the partnership at

Companies House or on their annual confirmation statement.

How do I choose my business’s SIC code?

Choosing a SIC code from a list of over 700 can be a little daunting. Companies House has complied a condensed list of SIC codes that splits the 700 codes into 21 industry categories. A good way to find your business’s SIC code is to look through these 21 categories and select the one that most fits your company.

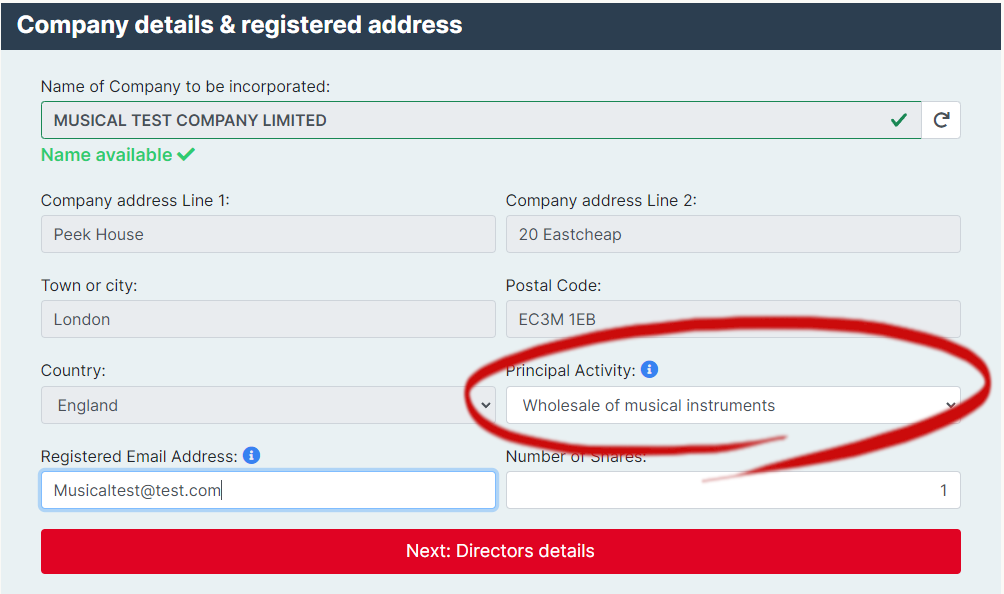

Let’s say, for example, a business wants to incorporate a company at Companies House to be able to sell flutes in bulk to other businesses. To find their SIC code they go to the condensed list and find the category of ‘Wholesale and retail trade’ in Section G. Within this category there is a SIC code of ‘Wholesale of musical instruments’ with code 46491.

When you incorporate a company with

easydigitalcompany.com you will need to add the SIC code when you complete the company details before incorporation:

There is also a search feature provided with this list where you can type in keywords related to your business’s activity or a more thorough but time-consuming method is to scroll through the entire list.

Where can I find my company’s SIC code?

When you incorporate your company at Companies House, certain information such as your registered office address and SIC code will be available for public record. If you are unsure what your SIC code is, Companies House is a great place to check.

Follow these steps to find your company’s SIC code on Companies House

- Go to the Companies House website

- Click ‘Find company information’ and enter your company’s name then click search

- Select your company from the results

- Your SIC code will be displayed at the bottom of the ‘Overview’ tab under ‘Nature of business (SIC)

What happens if I use the wrong code?

Fortunately, there are no government regulations or fines if you use the wrong SIC code to describe your business's activity. However, banks and other insurance providers can use your SIC code as a way of assessing your company. As SIC codes are available for the public to see, they could affect possible insurance or financial investments.

How can I change my SIC code?

A company may decide they need to change their SIC code for a number of reasons, perhaps the nature of the business's activity has changed or they have released that their current SIC code is incorrect. Luckily, you can change your business’s SIC code as many times as you like.

To change your SIC code you will need to file a confirmation statement. You can either wait until your confirmation statement is due, which is usually one year after you incorporated your company, or you can file your confirmation statement early.

When you file your confirmation statement, all you need to do is enter your new SIC code in the ‘Principal Business Activity’ section. Once filed, this will update your SIC code on the Companies House register.

Remember

- A SIC code is a five-digit code that classifies your business’s economic activity.

- Even if you are registering a dormant or non-trading company, you will still need to use a SIC code.

- To see your company’s current SIC code, go to the Companies House website and search your company’s name.

- You can change your SIC code by filing a confirmation statement.

This article is information only and has been prepared for general guidance on matters of interest only, and does not constitute legal, accounting, tax, investment or other professional advice or services. You should not act upon the information contained in this article without obtaining specific professional or legal advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this article, and, to the extent permitted by law, Comdal Limited, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.