Key Terminology for Issuing Shares in a Limited Company

There are many different terms and words which are used when talking about issuing shares when incorporating a Limited Company at Companies House, which can get confusing. Here you can find a mini dictionary for those exact terms and words:

Nominal Value - This is the price that is assigned to shares when a company is incorporated and is the minimum price that those shares can be sold for when the shares are first issued.

Share - The unit that represents ownership of a Limited Company.

Share Capital - This is the calculated by the number of shares issued multiplied by the Price Per Share.

Shareholder - An individual or entity that has invested its funds into a Limited Company in order to receive a 'Share' of the ownership.

Certificate of Incorporation - The document which is issued to a limited entity once it is registered with Companies House that contains information such as the Registered name and Company number.

Memorandum of Association - This is a legal statement signed by each of the initial shareholders/guarantors agreeing to form the company

What is a Share?

As stated above, a share is the unit that a parties ownership within a limited company can be measured by. If you own a share of a company you therefore own a percentage of that company. The amount of the company that you own would depend on the number of shares that have been issued. The number of shares that have been issued for the company are what will determine the percentage of ownership that each share represents. In the table below are some examples of how the number of shares issued would impact the ownership per share:

| Number of Shares | Ownership Per share (%) |

| 1 | 100 |

| 10 | 10 |

| 20 | 5 |

| 100 | 1 |

If you are to be the only person who owns the limited company than issuing one share when incorporating a limited company will be adequate as that singular share represents 100% ownership of the company. Where as if you wish to incorporate a limited company and have 5 separate shareholders then you may wish to issue 100 shares. With 100 shares issued each shareholder could then be given 20 shares with each share representing 1% ownership in the company. Therefore each of the 5 shareholders will own 20% of the company.

Within this table are some examples of the different ways that a company can issue shares and how these would effect the share capital of a limited company:

| Number of Shares | Nominal Share Value | Total Share Capital |

| 1 | £1 | £1 |

| 100 | £1 | £100 |

| 50 | £5 | £250 |

| 20 | £25 | £500 |

| 10 | £100 | £1,000 |

Some thing to note about issuing shares is that owning shares in a limited company does not mean that you as a shareholder are personally liable for the company's debts but shareholders can be liable for debts up to the value of the shares that they own.

Another point that should be noted is that once a limited company has been incorporated it must have a minimum of one share issued at any point in time and that share must also be owned by an individual or entity.

Who can own shares?

Shares within a limited company can be owned by people, partnerships, limited entities or any kind of organisation. Meaning that the term shareholder is not exclusive to individuals who own shares within a company. Any party that owns shares within a limited company can be referred to as a shareholder.

To be a shareholder the party must own at least one share within the private limited company, though this share could cost any nominal value ranging from £0.01 to £1,000 or higher.

How Do I Issue Shares When Incorporating a Limited Company Using Easy Digital Company?

You are deciding to start a new limited company for any one of a million different reasons whether you wish to be your own boss or as a passion project, we are here to help you throughout your businesses life. That starts with the most important step, incorporating a limited company. When incorporating your limited company using EasyDigital.Company issuing shares is easily done by following the steps outlined below:

Step 1

The first step is purchasing the incorporation of your new limited company along with any of our additional packages such as our registered address service, which keeps your personal information off the Companies House register.

Step 2

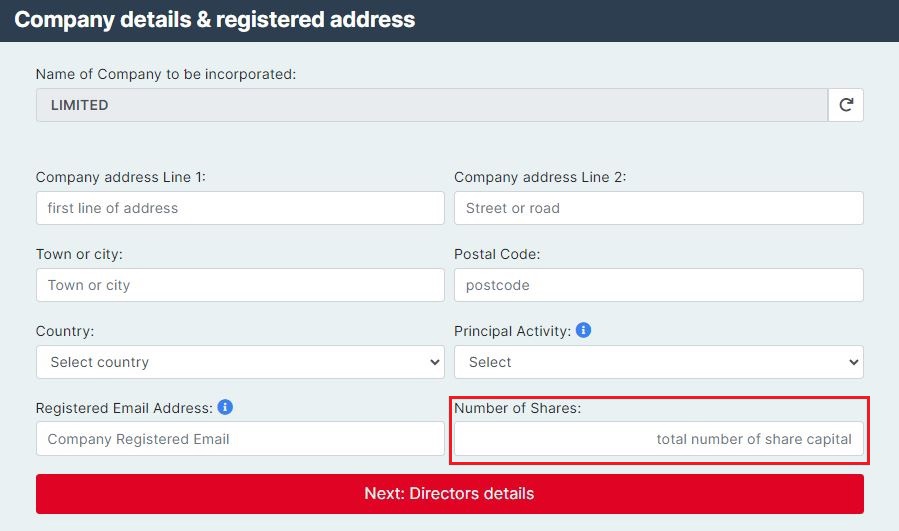

Once purchased, you can now complete the 'Company's Details & Registered Address'. Part of this form is issuing shares. Please complete the 'Number of Shares' box. This can be done by inputting the number of shares that you wish to issue within your limited company into the box circled below:

Step 3

The next step in incorporating a company is to complete the sections about the Directors Details and upload each Directors Proof of Address and Proof of Name in order to pass their Anti Money Laundering Checks with ease! After this is done your next step is to review the details input to ensure you are happy. This is where you can find confirmation of the company's 'Initial Share Capital'.