Business banking apps

If you’ve set up a

limited company in the UK that is registered with Companies House, one of the first things you’ll need to do is open a business bank account – to comply with company law and properly managed company finances. Separating your business transactions from your personal transactions helps simplify bookkeeping and helps ensure you keep accurate records for

HMRC and Companies House. It makes it easy to track income, supplier and customer payments and manage and pay taxes such as Corporation Tax and VAT. It offers the benefit of building a strong credit rating for your company, which can make it ideal when you require additional funding such as a loan or other sources of finance to help the business flourish.

Many UK business banking apps such as Tide, Starling and Monzo which are FCA regulated (Financial Conduct Authority) also offer little to no fees, easy account set-up and features like invoicing tools, expense tracking, business insights & analytics, integrated accounting software are available depending on the bank. These all help with the bookkeeping and financial records that all small businesses need to keep. That said, it’s definitely worth, browsing and comparing the available bank accounts and finding one that fits your business needs.

HMRC and Companies House portals

Every UK company director will be expected to register and use these official government portals so they can maintain the company compliance with requirements for filing and legal filing obligations.

HMRC’s Government Gateway: used to file for Corporation Tax, VAT, PAYE.

Companies House WebFiling: used to submit annual accounts, Confirmation Statements, and company changes like director appointments or registered office updates.

Directors were previously able to use the Company Accounts and Tax Online (CATO) service, which allowed companies to meet their filing obligations to both

HMRC and Companies House. But the government has confirmed that CATO will permanently close on 31 March 2026. From this point onwards small business will need to use

HMRC recognised software providers

What does this mean for small business owners?

If you have previously used CATO, you’ll need to download and save at least the last three years of filings, because the service will no longer be accessible after it shuts down.

So, from the 1 April 2026, companies are expected to use commercial software to file their Company Tax Returns (CT600) and full accounts to HMRC. Company accounts will need to be filed separately, either via third party software, the Companies House WebFiling service. Find out more about

CATO closure.

Third party filing software (e.g. Easy Digital)

With CATO closing, third party filing software is an important tool for small businesses. This is exactly where Easy Digital comes in - providing a simple and reliable way to stay compliant with

HMRC and Companies House. Getting started is straightforward - you can create a free account and begin setting up your filings right away.

Companies House & HMRC:

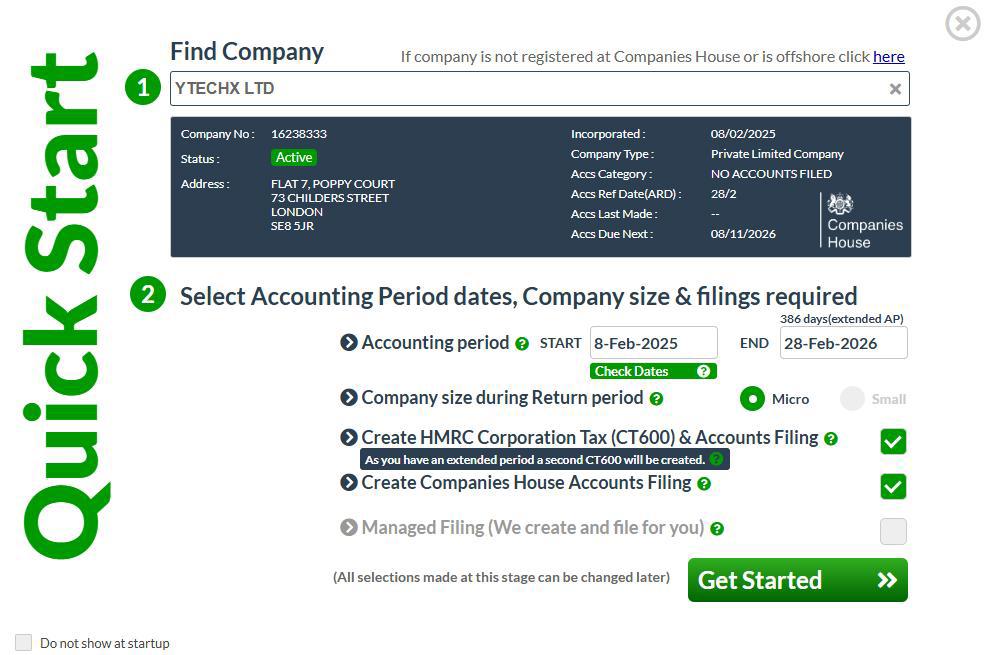

To file to Companies House & HMRC, please click ‘add filing’ (top right blue button) and select ‘Quick Start, Company & Filing selector’. You can then double check the accounting period, and company size (micro or small), and then tick both HMRC and Companies House options. Click ‘get started’.

The filings will then be created in your account, which you can complete using your end of year figures. You’ll also need your Companies House authentication code, UTR number and user ID and password to your government gateway account to successfully submit to both HMRC and Companies House.

You’ll also be able file your Confirmation Statement through Easy Digital. Here’s how. When selecting, ‘add filing’, select ‘company house templates’ in the show me product filter. Then, select the ‘Companies House Annual Confirmation Statement’. This should then add the template to your account – you’ll need to complete the following sections:

- Companies House authentication code

- Registered email address - as of 5 March 2024, all companies are required to provide a valid email address.

- Confirm that the intended future activities of the company will be lawful

- Approved by (Name) and approved on (Date)

Accounting software for Bookkeeping

Keeping accurate financial records is a crucial part of running a small business and company compliance, but it can also be time-consuming. Good bookkeeping not only shows you how your business is performing but also gives you the confidence to make better decisions. While there’s no legal requirement to use bookkeeping accounting software, it can make day-to-day financial management much easier. The right tools can save you time, cut down on errors, and give you a clearer picture of your cash flow and overall performance

Some of the main benefits of using accounting software include:

- Time savings - it can handle repetitive tasks like bank reconciliations, invoicing, and expense tracking automatically.

- Accuracy - helps reduce mistakes and keeps your records consistent.

- Real-time insights - gives you a quick view of cash flow, outstanding invoices, and overall profitability.

- Collaboration - makes it easy to share access with your accountant, bookkeeper, or business partners.

For small businesses, these benefits can make every day financial management and company compliance simpler and more reliable, leaving you more time to focus on growing your business.

Running a small business in the UK comes with a lot of responsibilities, but having the right tools in place can save time, reduce stress, and keep your company compliant. From choosing a business bank account and navigating HMRC and Companies House filings, to adopting reliable accounting software, these four essentials will help you stay organised and focused on growing your business.

This article is information only and has been prepared for general guidance on matters of interest only, and does not constitute legal, accounting, tax, investment or other professional advice or services. You should not act upon the information contained in this article without obtaining specific professional or legal advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this article, and, to the extent permitted by law, Comdal Limited, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.